Foundation Committee

The District Charitable Foundation exists to assist clubs who do not have their own foundation. The Foundation Trustees are Cheryl McIntyre (Chair)on Broida, Dennis Gorman (Treasurer), Chris Reilly (Secretary) and Bonnie Sanchez-Carlson.

REGISTERED CLUBS

- Channahon-Minooka

- Chicago Citywide Service

- Chicago Club Coalition

- Chicago Cosmopolitan

- Cicero-Berwyn

- Darien

- Maywood-Proviso

- Naperville Downtown

- The Southland

The Charitable Foundation of Rotary 6450, Inc. (“Foundation”) accepts donations to fund charitable and educational activities developed and sponsored by Rotary International District 6450, Inc. and its member Rotary Clubs. District Grant Projects of The Rotary Foundation of Rotary International may be eligible for The Charitable Foundation. Global Grant Projects of The Rotary Foundation of Rotary International, Inc. are not eligible for registration and funding through The Charitable Foundation. See below for more details about the purpose of the Charitable Foundation and process for becoming a registered club.

The IRS has designated the foundation as a 501(c)(3) charity.

The Foundation holds an Illinois Sales Tax Exemption as a registered charity.

Club projects operated through the District Charitable Foundation are eligible to use the sales tax exemption.

There is an annual fee of $25 for a Club in our District to maintain an account with the Foundation.

Policies and Procedures

The Charitable Foundation Policies, Application and Forms

Submit this form to set up your club’s account with the Foundation, the $25 annual fee must be included.

Project Approval Form

Submit this form for each project prior to the start of the project, once you have been approved for an account with the Foundation.

Charitable Foundation Project Check Request

Submit for distributions of projects.

The Charitable Foundation of Rotary 6450, Inc. (“Foundation”) has been established to accept donations to fund charitable and educational activities developed and sponsored by Rotary International District 6450, Inc. and its member Rotary Clubs in good standing. These include community service projects generally in the following areas of focus.

- Prevention and resolution of conflicts and the promotion of peace

- Prevention and treatment of disease

- Clean water and sanitation

- Maternal and child health

- Basic education and literacy

- Economic and community development

Global Grant Projects of The Rotary Foundation of Rotary International, Inc. are not eligible for registration and funding through The Charitable Foundation. Clubs must open independent checking accounts per The Rotary Foundation policies. Additionally, The Rotary Foundation has set up appropriate mechanisms for donors to give to Global Grant projects directly to The Rotary Foundation.

District Grant Projects of The Rotary Foundation of Rotary International may be eligible for The Charitable Foundation.

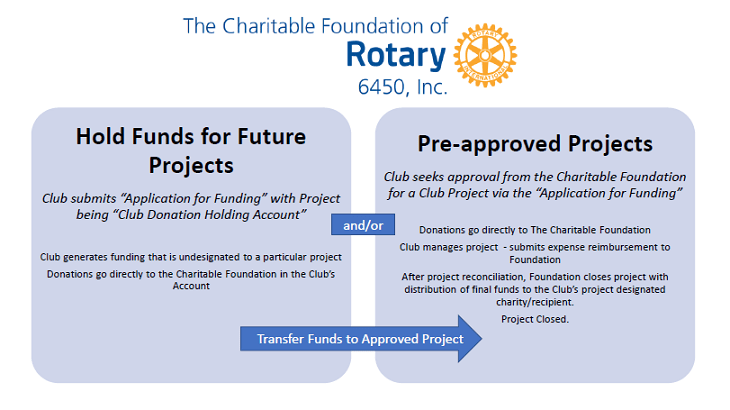

The Process for registering a club and project with the Foundation:

Club – Complete the Grant Submission Agreement Form, have the club president or authorized officer sign and submit.

Projects – Once a grant agreement form has been submitted, reviewed and approved by the Trustees of the foundation…Complete the Application For Funding form for each project/grant. Once completed, submit to the Foundation for preliminary review and, upon approval, will be posted on the district’s web-site as a project open for contributions.

Contributions

May be made by credit card either on a club website, with an account specifically established for receiving donations and deposited into the Foundation’s checking account or by check mailed to the current Charitable Foundation treasurer. Donations by check will credit the project for 100% of the donation. Donations by credit card will credit the project for 96% of the donation to cover the credit card processing fees. Mailing address:

The Charitable Foundation of Rotary 6450, Inc.

400 E. Randolph St., #2305

Chicago, IL 60601

The Foundation treasurer will send tax-deductible donation receipts to the donors. The project funding originator will be advised of contributions received and the web page will be updated with the project funding status.

Contributions must designate a specific exempt purpose, for example

- HealthRays Digital X-Ray Project

- District Grant #for Rotary Club of ___________

- Rotary Club of __________ club project (recipient must meet IRS definition of exempt recipient)

- ShelterBox on behalf of _____________

Disbursing Funds

Once all funds for a particular project are received, the project contact will be asked for payment instructions. All contributions will be kept in the Charitable foundation bank account until projects are fully funded and payment instructions received. In the event that a project or a part of a project is abandoned by the originator, the default recipient of the funds will be The Charitable Foundation of Rotary 6450, Inc.

Illinois Sales Tax Exemption

The Charitable Foundation of Rotary 6450, Inc. will provide, upon request, an Illinois letter of sales tax exemption to vendors, facilities, etc. that are used for a specific project. These letters will be custom to the specific project approved by the Foundation and must not be used, under any circumstances for Rotary Club related expenses. Rotary Clubs are recognized as 501c4’s by the IRS and are not recognized in the State of Illinois as a charity. Misuse of the Sales Tax Exemption of the Foundation will result in immediate termination of any registered grant project with the foundation.

Use of Tax Exemption Number

Clubs which have annually filed a Grant Submission Agreement, approved by the Foundation, may provide the Foundation’s tax-exempt number to vendors which provide goods or services for the Club’s charitable purposes, as long as a Grant/Project Application for Funding has been submitted and approved by the Foundation. For example, a baseball team donates tickets for prizes at a club fundraiser (which is registered with the Foundation).

Check Requests for Approved Service Projects

Checks from The Charitable Foundation of Rotary 6450, Inc. will only be written to Grant recipient organizations or grant project sponsoring Rotary Clubs. If a member of the club has, for example, purchased supplies for a project with his own credit card – they should submit to the Club all the original receipts; the Club should reimburse the member; and, then the Club submit to The Foundation a check request, with all receipts. The Club will be reimbursed promptly.